Table of Contents

What Is Commercial General Liability Insurance and What Does It Cover?

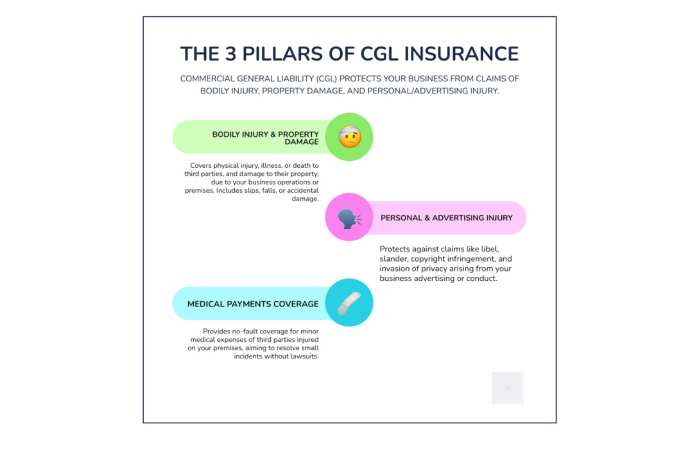

At its core, Commercial General Liability (CGL) insurance is designed to protect your business from claims of bodily injury, property damage, and personal and advertising injury that arise from your business operations, your premises, or your products and services. It’s often referred to simply as “general liability insurance” or “business liability insurance.”

Think of it as your primary defense against the financial repercussions of third-party claims alleging negligence on your part. This means if someone outside your business (a customer, client, vendor, or even a passerby) claims they were harmed or their property was damaged due to something your business did or didn’t do, your CGL policy can respond. Crucially, CGL policies also cover the significant legal defense costs associated with these claims, regardless of whether your business is found liable.

To better understand its scope, let’s break down the three main pillars of CGL coverage:

Bodily Injury and Property Damage Liability (Coverage A)

This is arguably the most fundamental component of CGL insurance.

- Bodily Injury: This covers claims that a third party sustained physical injury, illness, or disease, including death, as a result of your business operations or premises. This can include common scenarios like a customer slipping and falling on a wet floor in your retail store, or a client tripping over equipment left out at your office. It can even extend to mental injuries and emotional distress, even without physical harm, as some policies define bodily injury broadly. Your CGL policy would help cover medical expenses, lost wages, and legal defense costs if a lawsuit arises.

- Property Damage: This covers claims that your business caused damage to a third party’s tangible property. For example, if a contractor accidentally damages a client’s fence while working on their property, or if an employee causes a water leak that damages a neighboring business’s inventory, CGL would help pay for the repair or replacement of that property, as well as any associated legal fees. This coverage also often extends to “products-completed operations,” meaning damage that occurs after your work is finished or your product is sold.

Personal and Advertising Injury Liability (Coverage B)

While Coverage A deals with physical harm and property, Coverage B addresses non-physical injuries related to reputation or advertising practices. This can be a surprising but vital aspect of CGL. It protects your business against claims such as:

- Libel and Slander: False and damaging statements made about an individual or organization (written or spoken).

- False Arrest, Detention, or Imprisonment: Unlawful restraint by your business or its employees.

- Malicious Prosecution: Initiating a baseless lawsuit against someone.

- Wrongful Eviction or Invasion of Privacy: Inappropriate actions related to a person’s private space or information.

- Copyright, Trademark, or Slogan Infringement: Using protected material without permission in your advertising or business operations.

- Misappropriation of Advertising Ideas: Using someone else’s advertising concept without their consent.

Where social media and online advertising are prevalent, the risk of inadvertently committing one of these offenses is higher than ever. CGL can provide crucial protection against the legal costs and damages associated with such claims.

Medical Payments Coverage (Coverage C)

This component of CGL is unique because it operates on a “no-fault” basis. It covers immediate medical expenses for minor injuries sustained by a third party on your premises or as a result of your operations, regardless of who was at fault.

The primary purpose of Medical Payments Coverage is to quickly resolve minor incidents without them escalating into larger, more costly lawsuits. By promptly covering a visitor’s emergency room visit after a small fall, for instance, your business can demonstrate goodwill and potentially prevent a more extensive claim or litigation. This coverage typically has a lower per-person limit than Coverage A’s bodily injury limits.

Key Policy Features and Terminology Explained

Navigating insurance contracts can be complex, with specific terms and structures defining how your coverage works. Understanding these key features and terminology is essential for any business owner seeking to maximize their protection. We’ll dig into how policies are triggered, how proof of insurance works, and how to set appropriate coverage limits.

Occurrence vs. Claims-Made Policies

When purchasing CGL insurance, you’ll encounter two primary policy types: “occurrence” and “claims-made.” The difference lies in how and when a claim is triggered for coverage.

- Occurrence Policy: This type of policy covers incidents that occur during the policy period, regardless of when the claim is reported. For example, if an incident happens in 2023 when you have an occurrence policy, but the claim isn’t filed until 2025, your 2023 policy would still respond, even if you’ve since changed insurers or retired. This provides long-term peace of mind for incidents that might have a delayed manifestation.

- Claims-Made Policy: This policy covers claims that are made (reported to the insurer) during the policy period, provided the incident also occurred on or after a specified “retroactive date.” If a claim is made after the policy period ends, it would generally not be covered unless you purchase an “extended reporting period” (ERP), also known as “tail coverage.” Claims-made policies are more common for professional liability but can sometimes be seen in CGL, especially for certain industries.

Here’s a quick comparison:

Feature Occurrence Policy Claims-Made Policy Trigger When the incident occurs When the claim is made (reported) Coverage Window Covers incidents during the policy period, indefinitely Covers claims made during the policy period, after retroactive date Tail Coverage Not needed May require Extended Reporting Period (ERP) for future claims Premium Trend Generally higher initially, more stable Generally lower initially, increases over time Understanding Certificates of Insurance (COI) and Additional Insureds

You’ll often hear about Certificates of Insurance (COIs) and Additional Insureds in the context of CGL, especially when dealing with clients, landlords, or contractors.

- Certificate of Insurance (COI): A COI is an official document issued by your insurance provider that summarizes your insurance coverage. It serves as proof that you have a CGL policy in place, detailing your coverage limits, policy period, and the types of coverage you carry. Clients, landlords, or project owners frequently request a COI before awarding contracts or allowing you to operate on their premises. It’s a quick way for them to verify your insurance status without needing to see your entire policy document. Many modern insurers offer instant COI generation through their online portals or mobile apps.

- Additional Insured: An additional insured is an individual or entity, other than the named insured, who is added to your CGL policy to receive coverage under specific circumstances. For example, a landlord might require you to add them as an additional insured on your policy. This means if a third party sues the landlord for an incident that occurred on your rented premises, your CGL policy would extend coverage to the landlord, protecting them from claims arising out of your operations. This is a common contractual requirement and is crucial for many business relationships.

Determining the Right Coverage Limits for Your Business

CGL policies come with specific coverage limits, which represent the maximum amount your insurer will pay for covered claims. Understanding these limits is vital to ensure you have adequate protection.

- Per-Occurrence Limit: This is the maximum amount your insurer will pay for any single covered incident or claim. For example, if you have a $1 million per-occurrence limit, the insurer will pay up to $1 million for all damages and legal costs related to one slip-and-fall incident.

- General Aggregate Limit: This is the maximum total amount your insurer will pay for all covered claims within a single policy period (usually one year). If your general aggregate limit is $2 million, and you have multiple claims throughout the year, the insurer will not pay more than $2 million in total, even if individual claims are below the per-occurrence limit.

The right amount of coverage for your business depends on several factors:

- Your Industry and Risk Exposure: High-risk industries (e.g., construction, manufacturing) typically need higher limits than lower-risk ones (e.g., consulting).

- Value of Your Assets: Consider the potential financial impact if your business were sued. A common rule of thumb is to have coverage at least equal to your company’s assets.

- Contractual Requirements: Many clients, landlords, or regulatory bodies will mandate specific minimum CGL limits. Always check your contracts.

- Business Size and Revenue: Larger businesses with more operations and higher revenue generally face greater exposure and should carry higher limits.

- Legal Landscape: In our litigious society, higher limits provide a stronger buffer against potentially devastating lawsuits.

While $1 million per-occurrence and $2 million aggregate are common starting points for many small businesses, it’s always wise to consult with an insurance professional to assess your specific needs and determine the optimal limits for your operations.

Who Needs CGL and How Much Does It Cost?

While CGL insurance isn’t legally mandated in most states, it is widely considered a fundamental and essential coverage for almost any business. The question isn’t usually “if” you need it, but “how much” and “what kind.”

Industries and Professionals That Require CGL

If your business interacts with the public, works on client property, sells products, or advertises its services, you have a direct need for CGL. Here’s a list of common professions and industries that almost universally benefit from or require CGL:

- Contractors and Tradespeople: Electricians, plumbers, carpenters, landscapers, painters, HVAC technicians, roofers, etc. (High risk of bodily injury or property damage on job sites).

- Retail Businesses: Shops, boutiques, grocery stores, salons, restaurants, cafes. (Premises liability for customers).

- Service-Based Businesses: Janitorial services, cleaning companies, event planners, photographers, personal trainers, marketing agencies. (Access to client property, public interaction, advertising risks).

- Consultants and IT Services: Even if you primarily work remotely, you might visit client sites or be involved in advertising.

- Landlords and Property Managers: Responsible for premises where others are present.

- Manufacturers and Distributors: Products-completed operations coverage is crucial.

- Any Business that Advertises: Protects against personal and advertising injury claims.

Even sole proprietors or home-based businesses should consider CGL. Your personal homeowner’s policy typically won’t cover business-related liabilities, leaving you exposed.

Factors That Influence the Cost of Commercial General Liability Insurance

The cost of CGL insurance is not one-size-fits-all. It varies significantly based on a multitude of factors unique to your business. While statistics show general averages, your specific premium will be custom to your risk profile.

Here are the primary factors that influence the cost:

- Industry Risk: Businesses in inherently riskier industries (e.g., construction, manufacturing) will pay more than those in lower-risk sectors (e.g., office-based consultants). This is the biggest determinant.

- Business Location: Geographic location impacts cost due to varying state regulations, local litigation trends, and population density.

- Claims History: A history of previous claims will likely result in higher premiums, as it indicates a higher future risk to the insurer.

- Coverage Limits and Deductibles: Higher per-occurrence and aggregate limits mean a higher premium. Choosing a higher deductible (the amount you pay out-of-pocket before insurance kicks in) can lower your premium, but means more personal expense if a claim occurs.

- Number of Employees and Payroll: More employees generally mean more exposure to potential claims, leading to higher costs. Payroll can be an indicator of business size and activity.

- Business Revenue: Higher revenue often correlates with more extensive operations and greater exposure, potentially leading to higher premiums.

- Years in Business: Established businesses with a clean claims history may receive more favorable rates than new ventures.

Cost Statistics: While costs vary, here are some general averages from our research:

- On average, small business owners pay around $42 per month or $504 per year for general liability insurance.

- The annual premium for general liability insurance costs $805, or about $67 a month, on average.

- In 2023, the national median cost of general liability insurance through Progressive was $59 per month. The average price was $80.

- Many small businesses, particularly those with lower risk profiles, pay approximately $30 per month or less for general liability insurance.

These are averages. Your actual cost will depend on your unique business profile.

Is CGL Insurance Required by Law?

This is a common question, and the answer is usually no, not by federal or state law in most instances. Unlike workers’ compensation insurance, which is legally mandated for businesses with employees in almost every state, CGL is rarely a statutory requirement.

However, while not legally required, CGL insurance is often a contractual requirement and a business necessity:

- Client Contracts: Many clients, especially larger corporations or government entities, will require proof of CGL insurance before they will work with your business or award you a contract. This is particularly true for contractors, consultants, and service providers.

- Landlord Agreements: If you rent commercial space, your landlord will almost certainly require you to carry CGL insurance and name them as an additional insured on your policy.

- Licensing and Permits: Certain industries or specific types of work may require CGL insurance to obtain or maintain business licenses or permits.

- Industry Standards: Even without a specific mandate, CGL is considered a best practice and an industry standard for most businesses. Operating without it can make it difficult to secure partnerships, attract clients, or even participate in bidding processes.

While the law might not force you to buy CGL, the marketplace often will. And more importantly, the financial risk of operating without it is simply too high for most businesses.

Understanding CGL Exclusions and Complementary Coverages

While CGL insurance is broad, it’s not all-encompassing. Like all insurance policies, it has specific exclusions—situations or types of claims that it does not cover. Understanding these exclusions is crucial for identifying potential coverage gaps and building a truly comprehensive insurance portfolio for your business.

Common Exclusions in a CGL Policy

Here are some of the most common types of claims or risks that a standard CGL policy typically excludes:

- Employee Injuries (Workers’ Compensation): CGL covers third-party bodily injury. Injuries to your own employees that occur on the job are specifically excluded and require a separate workers’ compensation insurance policy.

- Professional Errors or Negligence (Professional Liability): CGL covers general negligence related to your operations or premises. It does not cover claims arising from mistakes, errors, or omissions in the professional services or advice you provide. This requires professional liability insurance (also known as Errors & Omissions or E&O).

- Auto Accidents (Commercial Auto): Damage or injury caused by vehicles owned or operated by your business, whether on or off your premises, is excluded. This requires a commercial auto insurance policy.

- Intentional Acts: CGL policies are designed to cover accidental occurrences. Intentional acts of harm or damage caused by your business or its employees are generally excluded.

- Pollution: Claims arising from pollution or environmental contamination (e.g., chemical spills) are typically excluded. Specialized pollution liability insurance may be needed for businesses with this exposure.

- Damage to Your Own Property: CGL covers damage to third-party property. Damage to your own business property (building, equipment, inventory) from perils like fire, theft, or vandalism is covered by commercial property insurance.

- Liquor Liability: If your business sells, serves, or furnishes alcoholic beverages, claims related to intoxication (e.g., a customer causing an accident after being overserved) are excluded and require liquor liability insurance.

- Cyber Liability: Data breaches, cyberattacks, or other digital risks are not covered by CGL. This requires cyber liability insurance.

- Directors and Officers (D&O) Liability: Claims against your company’s directors or officers for wrongful acts in their managerial capacity (e.g., breach of fiduciary duty) are excluded and require D&O insurance.

General Liability vs. Professional Liability Insurance

The distinction between these two is a frequent point of confusion for business owners.

- Commercial General Liability (CGL) Insurance: Focuses on physical harm (bodily injury, property damage) and reputational harm (personal and advertising injury) to third parties, arising from your general business operations, premises, or products. It covers claims of general negligence.

- Example: A client trips over a loose rug in your office and breaks their arm (bodily injury).

- Professional Liability Insurance (Errors & Omissions – E&O): Focuses on financial harm to third parties resulting from errors, omissions, or negligence in the professional services or advice you provide. It covers claims of professional negligence.

- Example: A consultant provides flawed advice that leads to a significant financial loss for their client.

Many businesses, especially those offering professional services (e.g., accountants, IT consultants, marketing agencies, architects), need both CGL and professional liability insurance to ensure comprehensive protection.

Building a Complete Insurance Portfolio

Given the exclusions in a CGL policy, it becomes clear that a single policy is rarely enough for complete business protection. A robust insurance portfolio typically involves combining CGL with other specialized coverages custom to your business’s unique risks.

Beyond CGL, here are some common and often essential policies to consider:

- Workers’ Compensation Insurance: Legally required in most states for businesses with employees, this covers medical expenses and lost wages for employees injured on the job.

- Commercial Auto Insurance: Essential if your business owns or uses vehicles for business purposes, covering accidents, damage, and liability.

- Commercial Property Insurance: Protects your business’s physical assets, including your building, equipment, inventory, and furniture, from perils like fire, theft, and natural disasters.

- Cyber Liability Insurance: Crucial in today’s digital world, this covers costs associated with data breaches, cyberattacks, and other technology-related risks.

- Business Owner’s Policy (BOP): For many small to medium-sized businesses, a BOP is an excellent option. It bundles commercial property, general liability, and often business interruption insurance into a single, cost-effective package. This simplifies coverage and can often lead to premium savings compared to buying individual policies.

- Commercial Umbrella Insurance: This provides additional liability coverage above the limits of your primary CGL, commercial auto, and employer’s liability policies. It kicks in when the limits of your underlying policies are exhausted, offering an extra layer of protection against catastrophic claims.

For businesses seeking to tailor their coverage precisely to their operations, exploring options for customized business general liability insurance can provide peace of mind by addressing specific industry risks and contractual needs. A knowledgeable insurance advisor can help you assess your exposures and build a complete, seamless insurance program.

Frequently Asked Questions about Commercial General Liability Insurance

We’ve covered a lot of ground, but let’s address some of the most common practical questions business owners have about CGL insurance.

How are claims handled under a CGL policy?

The claims process typically follows these steps:

- Incident Occurs: A third party suffers bodily injury, property damage, or alleges personal/advertising injury due to your business operations.

- Report the Incident: You (the policyholder) must promptly report the incident to your insurance carrier. Provide all relevant details, including dates, times, witnesses, and any documentation.

- Investigation: The insurer will assign a claims adjuster who will investigate the incident. This may involve gathering statements, reviewing evidence, assessing damages, and determining if the claim is covered under your policy terms.

- Legal Defense (if applicable): If the incident results in a lawsuit, your CGL policy’s “duty to defend” clause kicks in. The insurer will appoint and pay for legal counsel to defend your business in court, even if the claim is baseless.

- Negotiation and Settlement: The adjuster and legal team will negotiate with the claimant or their representatives to reach a settlement.

- Resolution: If a settlement is reached or a judgment is made by the court, the insurer will pay the covered damages (up to your policy limits, minus any deductible). If the claim is found to be outside of coverage or dismissed, the insurer will close the claim.

It’s crucial to cooperate fully with your insurer throughout this process and avoid admitting fault or making promises to the claimant without consulting your insurer.

Is commercial general liability insurance tax deductible?

Yes, generally, commercial general liability insurance premiums are considered a legitimate business expense by the IRS and are therefore tax deductible. This means you can deduct the cost of your CGL premiums from your taxable income, effectively reducing your overall tax burden.

However, tax laws can be complex and are subject to change. We always recommend consulting with a qualified tax professional or accountant to confirm the deductibility of your specific insurance premiums and for personalized tax advice.

How can I purchase CGL insurance?

Purchasing CGL insurance is relatively straightforward, and you have several options:

- Stand-Alone Policy: You can purchase CGL as a separate, individual policy. This is common for businesses that might not need commercial property insurance (e.g., home-based businesses without significant business property) or those with highly specialized needs.

- Business Owner’s Policy (BOP): As mentioned earlier, a BOP is a popular and often cost-effective option for small to medium-sized businesses. It bundles CGL with commercial property insurance and usually business interruption coverage into one convenient package.

- Commercial Package Policy (CPP): For larger or more complex businesses, a CPP allows for greater customization. It can combine CGL with multiple other commercial coverages (like commercial auto, inland marine, crime, etc.) under a single policy, offering flexibility to tailor coverage to specific needs.

- Independent Insurance Agent/Broker: Working with an independent agent is highly recommended. They represent multiple insurance carriers, allowing them to shop around on your behalf, compare quotes, and help you find the best coverage and price for your specific business. They can also provide expert advice on your unique risks.

- Direct from a Carrier: You can also purchase CGL directly from an insurance company, often online or over the phone. This can be convenient, but you’ll be limited to that specific carrier’s offerings.

When purchasing, be prepared to provide details about your business, including your industry, services, revenue, number of employees, physical location, and any past claims history.

Conclusion

In the dynamic world of business, unforeseen events are not a matter of “if,” but “when.” Commercial General Liability (CGL) insurance stands as a cornerstone of risk management, providing essential protection against the significant financial threats posed by third-party claims.

From protecting against everyday incidents like slips and falls to defending against complex advertising injury lawsuits, CGL offers a crucial safety net. It covers not just the settlements and judgments, but also the often-crippling legal defense costs, allowing your business to continue operating even in the face of litigation.

While not always legally mandated, CGL is almost universally required by clients, landlords, and industry standards, making it an indispensable part of doing business responsibly. Understanding its core coverages, key terms, and common exclusions empowers you to make informed decisions about your business’s protection.

CGL is a foundational piece, but a truly resilient business insurance portfolio extends beyond it to include other vital coverages like workers’ compensation, commercial property, and professional liability, custom to your unique operations.

By proactively managing your risks and securing comprehensive commercial general liability insurance, you’re not just buying a policy; you’re investing in the peace of mind, financial stability, and long-term resilience of your business. Safeguard your hard work and secure your future with the right coverage.